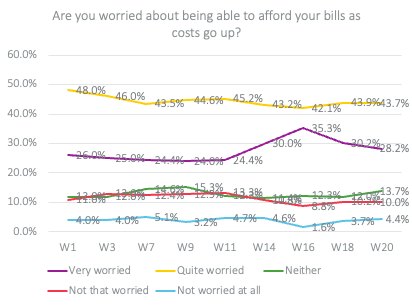

Three out of ten British individuals at the moment are ‘very fearful’ about their capacity to pay family payments, based on the most recent value of residing report from Shopper Intelligence.

The proportion has decreased from its 35% peak in late August, following the announcement of the power worth cap on 8 September. It does, nevertheless, stay greater than it was over the summer season. The survey was performed on 25 and 26 September, and won’t mirror the complete influence of mortgage price rises following the Chancellor’s Development Plan announcement of 23 September.

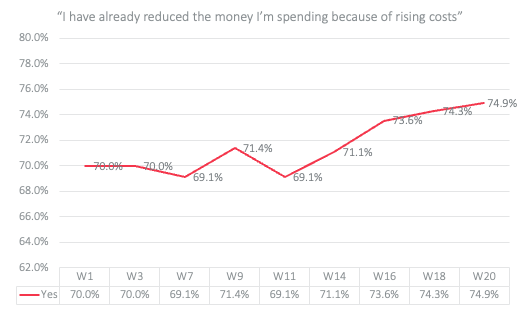

And it’s not simply the fear. The quantity of people that have already in the reduction of on spending has reached a brand new excessive of 75%, whereas half the inhabitants now studies having in the reduction of on heating.

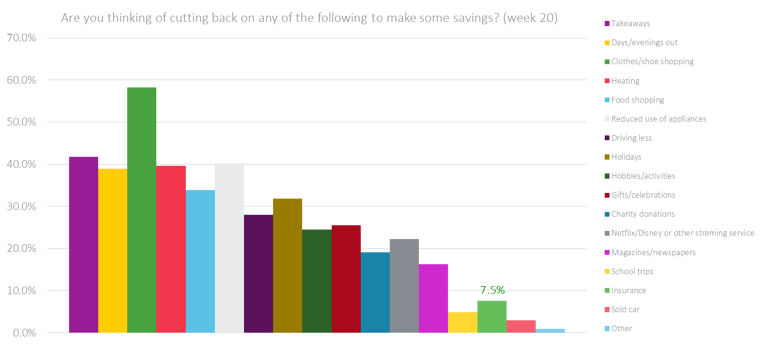

To this point, the insurance coverage trade has been fortunate, coming in direction of the underside of the checklist of cuts individuals have began to make, or are planning to make. However the newest figures recommend it’s not immune. Seven per cent stated they’d in the reduction of on insurance coverage prices within the final three months, whereas these considering of cancelling or buying and selling down insurance coverage is as much as 7.5% from 6% in June. It’s not an enormous statistical leap, however in actual phrases, it means round 2 million prospects trying to slash their insurance coverage spend.

In the meantime, after a surge of holidays in summer season 2022, it’s value noting precisely how many individuals are laying aside their subsequent one. 32% are going to chop again on holidays sooner or later, and 28% can be driving much less – each of which may additionally have an effect on insurance coverage – and particularly on new enterprise volumes.

Different way of life milestones being delayed embody having a child, 4%, shopping for a brand new automotive 9%, home purchases, 6%, and home renovations, 16%.