Within the face of continued claims inflation, new knowledge from Client Intelligence reveals the house insurance coverage market might be making strikes to guard itself.

The price of building supplies has seen a major improve since 2021 following a collection of financial components. Pile on will increase in labour prices in addition to provide points for key constructing supplies like concrete and metal, and it’s no surprise residence insurers are dealing with substantial uplifts in the price of claims and repairs.

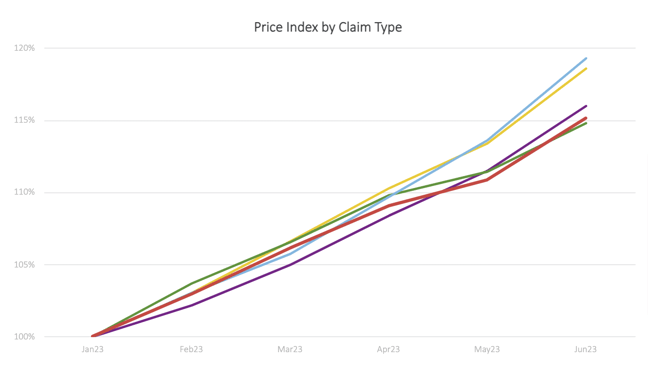

Based on a report revealed by Go.Examine earlier this 12 months, water and harm claims have been the most typical declare sort for the house sector in 2022. Within the first half of 2023, water and harm claimants confronted greater premium inflation, when in comparison with different forms of claimants and people with no claims.

Escape of water claims incurred a median improve of 19.3% over the six-month interval and harm claims noticed an 18.6% improve. In distinction, premiums rose 16% for constructing claimants, 14.8% for theft claimants and 15.1% for non-claimants.

While the distinction could appear marginal between these two teams once we have a look at the trended view, we are able to see a transparent divergence emerge in April 2023 and proceed via to June 2023 – presumably an indication of the market responding to the earlier 12 months’s claims knowledge in an effort to guard mixed working ratios.

SOURCE: CI MARKET VIEW (PCW PRICE BENCHMARKING). SAMPLE SIZE: 2100 RISKS RUN EACH MONTH PER PCW.

|

Declare Sort |

YTD inflation |

|

Escape of Water |

+19.3% |

|

Harm |

+18.6% |

|

Constructing |

+16.0% |

|

No Claims |

+15.1% |

|

Theft |

+14.8% |

This isn’t the one transfer we’ve seen inside the market. Some manufacturers seem like steering away from claimants by quoting much less. In June 2023, 14 manufacturers quoted for a smaller proportion of claimants than non-claimants, by not less than 10% – together with two manufacturers not quoting for claimants in any respect.

After we have a look at the manufacturers best for claimants, 5 out of 6 inflated premiums extra for claimants in comparison with non-claimants – clearly demonstrating the house markets transfer to guard itself in opposition to claims inflation.