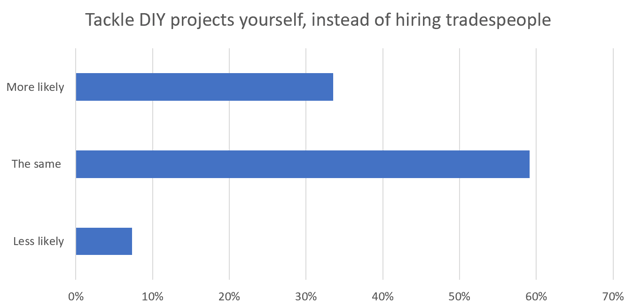

One third of the inhabitants (33.52%) say they’re extra more likely to strive fixing issues round their residence themselves due to the cost-of-living disaster – as an alternative of hiring skilled tradespeople.

With 6% pushing aside a brand new home buy and 16% pushing aside a correct residence renovation, insurance coverage firms may properly see extra individuals making an attempt their very own residence enhancements – and see extra DIY bodge-jobs as an surprising side-effect-sign of the economic-times.

Shopper Intelligence CEO Ian Hughes mentioned: “We’ve now been monitoring the impression of the cost-of-living disaster for six months, and what we’re seeing is various levels of desperation – and innovation. Individuals are making cuts, they’re making do – and so they’re clearly beginning to do it themselves, too.

“The insurance coverage trade shouldn’t be resistant to these cuts – instantly or not directly. Because of feeling financially squeezed, 30% would think about a decrease high quality or fundamental insurance coverage coverage, and 27% would now think about paying in instalments. Whereas solely round 6% are planning to really cancel their insurance coverage, residence contents insurance policies are in the direction of the highest of the listing for these seeking to swap or cancel.

“If the identical persons are additionally seeking to tackle DIY tasks un-qualified and with out insurance coverage back-up, which may find yourself being an issue – and much more of an expense than an preliminary premium.”

Different extra uncommon areas individuals want to make financial savings embody taking up money in hand jobs (16% are extra probably to take action), promoting and shopping for gadgets second hand (32-33%) and ‘up-cycling’ issues like furnishings (26%).

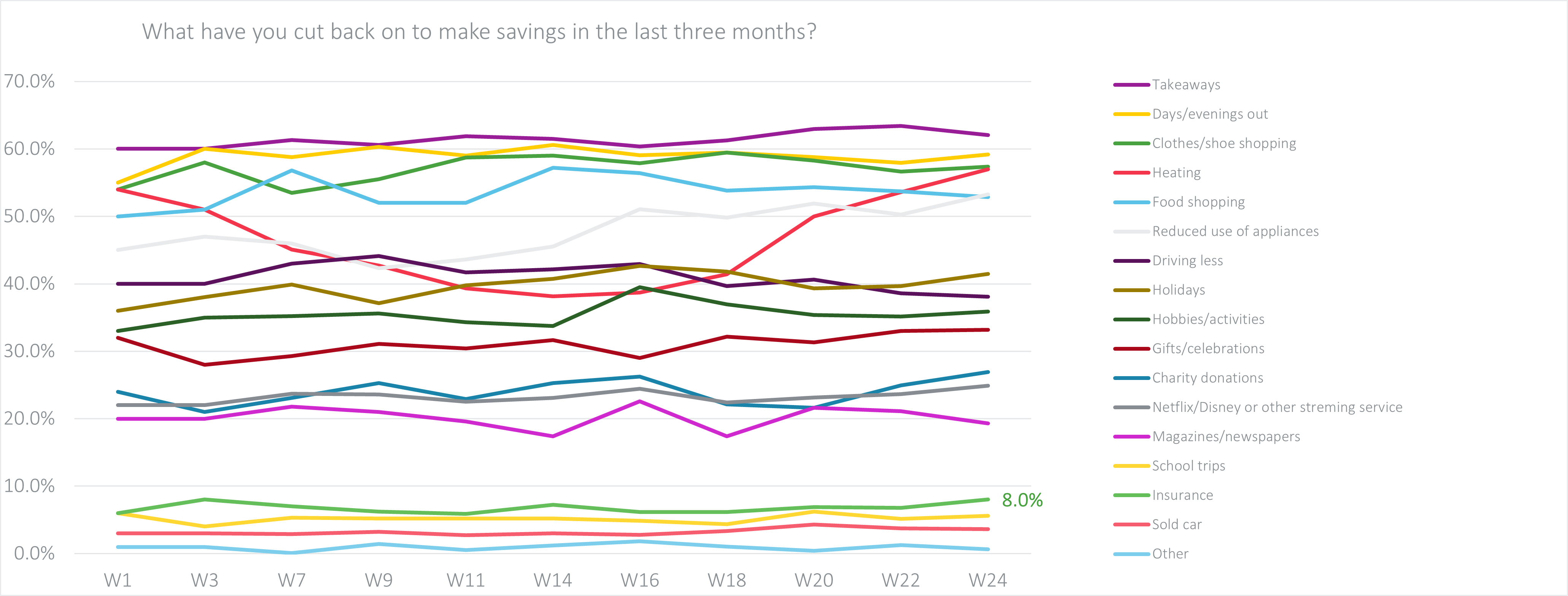

Heating and equipment stay are the quickest rising areas to make cuts, and heating, take-aways, procuring and days/evenings out are persistently on the high of the cull listing.

Spending Cuts

Value of Residing Tracker (Week 1, 7 Could 2022 – Week 24, 23 October 2022)

Six months of value of dwelling

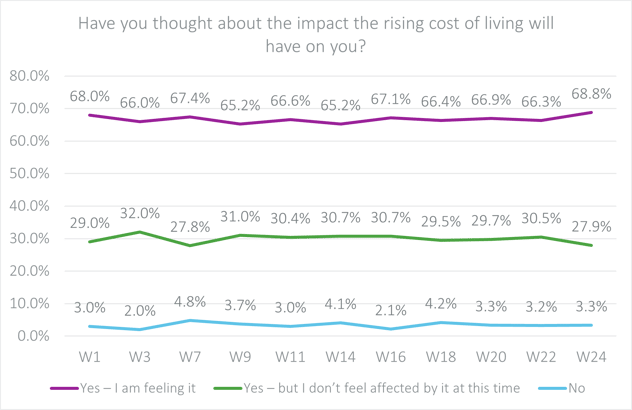

Each two weeks, Shopper Intelligence has requested individuals how they really feel about the price of dwelling, how anxious they’re about cash – and what cuts they’re planning to make.

In opposition to a backdrop of ongoing political and financial chaos, dropping temperatures and Christmas simply not far away, it’s maybe unsurprising that by the shut of October the variety of individuals feeling the pinch personally hit an all-time excessive – as much as almost 69% from 66% two weeks in the past, with these aged 25-44 most certainly to be feeling that pressure.

The impression on shoppers

Week 24 (22-23 October 2022)

| Have you considered it? | 18-25 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

| Sure, I’m feeling it | 69.81% | 73.94% | 77.60% | 68.16% | 65.06% | 61.39% |

| Sure, however I’m not impacted presently | 26.42% | 19.15% | 19.13% | 28.86% | 32.53% | 37.07% |

| No | 3.77% | 6.91% | 3.28% | 2.99% | 2.41% | 1.54% |

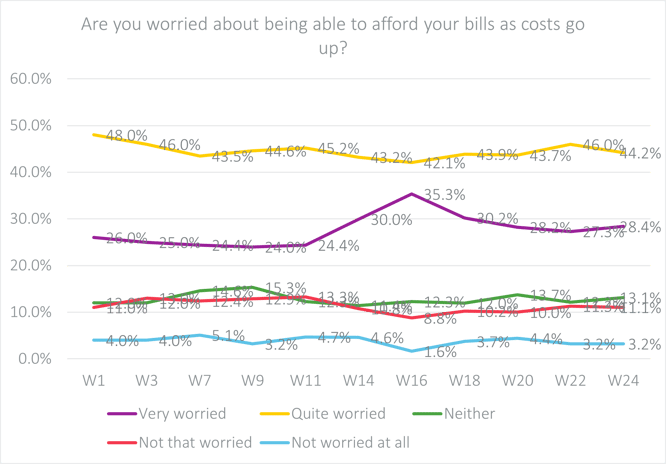

However regardless of this, in general phrases ranges of fear have remained comparatively secure in latest weeks. Practically three quarters of Brits are fairly or very anxious about with the ability to pay their payments, however the variety of individuals most involved has dropped from a summer season excessive of 35%, and now stands at 28% – up solely very barely from two weeks in the past. These ‘fairly anxious’ have additionally dropped.

Stage of fear

At this stage that may very well be down to fret fatigue, or it may very well be that the instant financial instability of Kwasi Kwarteng’s mini finances was rolled again far sufficient and quick sufficient to not have registered in responses.

Ian Hughes continued: “There’s been no time when shoppers have been underneath extra strain – and strain that’s so consistently evolving. Maintaining with the modifications is hard on shoppers, and difficult on the suppliers making an attempt to gauge pondering, predict behaviour and reply in ways in which may truly assist their clients.

“If clients and cost-of-living aren’t entrance and centre of your pondering proper now, they most likely ought to be. And catching up with the nuances of actual time reactions during the last six months may very well be an excellent place to start out.”

October Report – Value of Residing Shopper Behaviour Tracker

With our ‘Value of Residing’ Shopper Behaviour Tracker, you’ll be able to observe altering sentiments, attitudes, and behaviours, as shoppers proceed to face the rising value of dwelling.