Buyer understanding of normal insurance coverage merchandise could also be decrease than many corporations realise – and decrease nonetheless on account of the proliferation of tiered merchandise which usually strip out cowl and lift excesses.

In a Viewsbank survey of 1056 individuals carried out in February, Shopper Intelligence discovered that data about cowl ranges and extra charges different extensively.

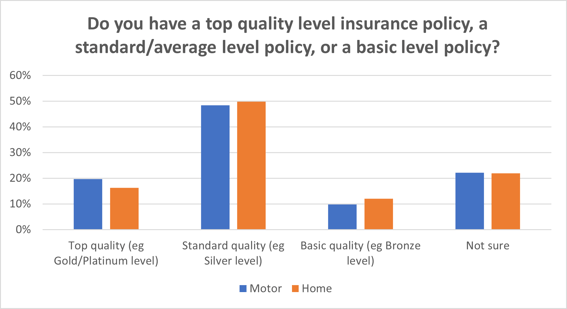

Greater than 1 in 5 of these with insurance coverage had no concept what degree of motor (22%) or dwelling (21%) cowl they’d bought – prime, commonplace, or primary.

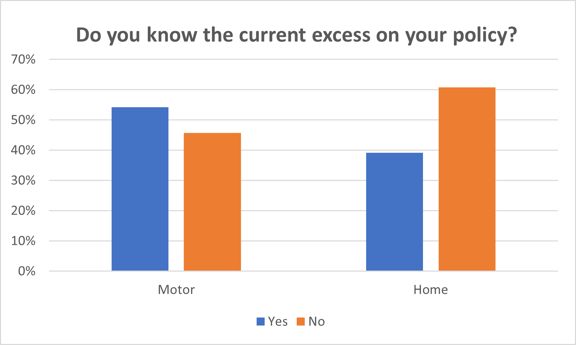

When requested in additional element in regards to the degree of canopy that they had, as many as 46% of automotive insurance coverage clients had no concept how a lot extra they’d agreed to pay within the occasion of a declare, rising to almost 60% of dwelling clients.

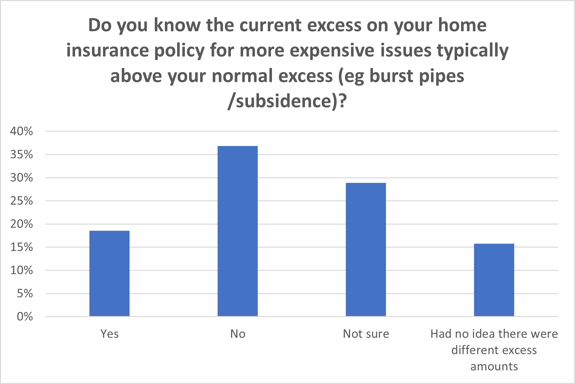

Maybe extra worryingly given the prices concerned, 15% of dwelling insurance coverage customers had no concept their dwelling insurance coverage extra may very well be increased for issues like burst pipes or subsidence, with 37% admitting that they had no concept what they may be liable to pay.

Shopper Intelligence’s Head of Shopper Technique Catherine Carey explains: “We’ve seen an explosion of product tiers following the Basic Insurance coverage Pricing Practices (GIPP) reforms, with manufacturers bringing out bronze/silver/gold variations to serve completely different client budgets – and to get a bonus on the Value Comparability Web sites.

“To be honest, it’s a technique the FCA has largely accredited of, notably because it offers weak clients – as an example these battling payments through the cost-of-living disaster – with inexpensive cowl choices. However make no mistake, client understanding is a key pillar of the forthcoming Shopper Responsibility – and it seems like corporations would possibly must spend extra time guaranteeing their clients actually perceive what they’re getting – and never getting – after they go for a graded product.”

And many individuals ARE fascinated about downgrading at their subsequent renewal. Our survey discovered that 31% of motor customers would think about going for a less expensive model of their coverage with much less cowl, with 29% nonetheless on the fence. 26% of dwelling insurance coverage customers would think about a downgrade – with 25% nonetheless not sure.

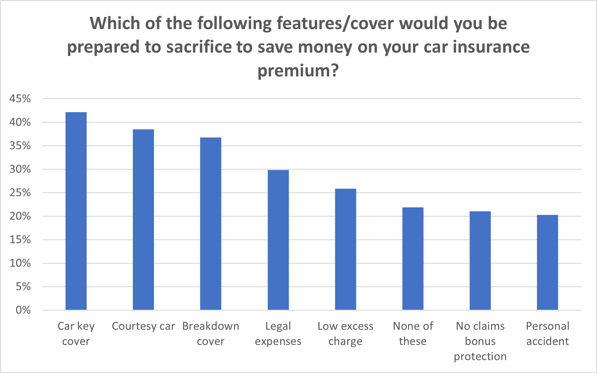

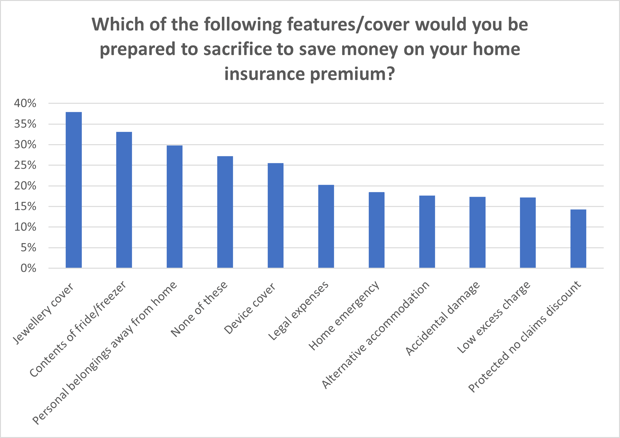

What turned actually attention-grabbing was what individuals thought they may select to sacrifice from a coverage so as to pay much less for it.

Key cowl was a function 4-in-10 drivers mentioned they might do with out, adopted by a courtesy automotive and breakdown cowl. 29% would sacrifice authorized bills, and 26% mentioned they’d be ready to let go of their decrease extra cost. Which when so many indicated they didn’t know what their present extra really was, appears to point an essential understanding hole.

In the meantime, barely fewer householders mentioned they’d go for sacrificing their low or decrease extra payment (17%), with the most well-liked factor to lose being jewelry cowl, adopted by fridge/freezer contents, after which private belongings away from the house. 1 in 4 would sacrifice system cowl.

With that together with costly gadgets like telephones and laptops, it’s once more unclear whether or not persons are really pondering via and understanding the implications of much less complete cowl.

Catherine Carey added: “The actual crux of the issue is that many lower-tiered merchandise are so priced as a result of they strip out precisely the types of parts or extras we requested individuals in the event that they’d be tempted to go with out. Additionally they sometimes elevate excesses as well – probably to a degree that many purchasers focused on price range choices merely wouldn’t be capable of afford.”

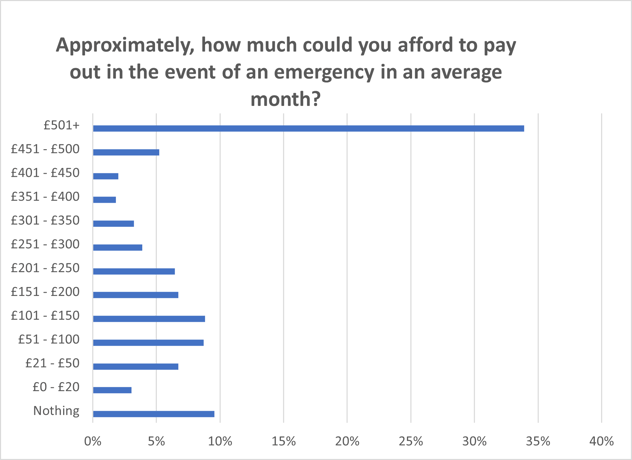

Once we requested individuals about whether or not they had cash put aside in financial savings for home emergencies, we discovered that 30% admitted they didn’t. Digging down, we requested how a lot they may be capable of afford to pay out in an emergency in a typical month. Whereas 35% might discover £500+, 10% might pay nothing. One other 10% had lower than £50 to spare.

With automotive extra on some lower-tiered insurance policies robotically set at £250+ – there’s a clear and regarding hole. And people going through the surplus charges for one thing like escape of water would discover themselves in much more issue.

They’re findings which can be mirrored within the FCA’s newest Monetary Lives Survey, which discovered that 1-in-4 Brits are in monetary issue – or might shortly discover themselves in issue in the event that they suffered even a modest monetary shock – with round 32 million already discovering it a burden to maintain up with payments.

Catherine Carey continued: “In the event you can’t afford to interchange your cellphone, pay somebody to choose you up from the facet of the motorway, get a rent automotive to do the college/work run whereas yours is being mounted, name somebody out to repair your boiler, or pay the surplus to repair your leak – then your price range coverage instantly isn’t very ‘inexpensive’ is it? The FCA needs to ensure individuals perceive that commerce off earlier than they purchase.

“Our job as an trade is to offer individuals with a security web. If we’re focusing on price range merchandise at individuals who in actuality received’t be capable of use them within the occasion of a declare, we’re open ourselves as much as poor client outcomes.

“Sure, the FCA wants us to cater for weak clients – however they’ve been very clear that that’s THROUGH a lens of Shopper Responsibility. It’s time to consider whether or not your price range traces are actually providing honest worth, and whether or not they’re actually serving to those that actually need assistance – exactly after they want it most.”

Perceive the wants and motivations of your clients or audience.

Our Viewsbank panel helps our clients with all kinds of tasks starting from detailed thriller procuring to demographically focused analysis surveys. The analysis helps our purchasers make knowledgeable choices primarily based on true understanding of the patron’s voice.