An insurance coverage start-up based by three former Allianz executives that goals to ensure firms shopping for carbon credit get the permits they’ve paid for has closed the most important European climate-focused seed funding spherical in additional than a 12 months.

CarbonPool raised 10.5 million Swiss francs ($12.17 million) within the spherical led by Heartcore Capital and Vorwerk Ventures, two executives instructed Reuters, alongside HCS Capital, Revent Ventures and former Allianz board members Axel Theis and Christof Masher.

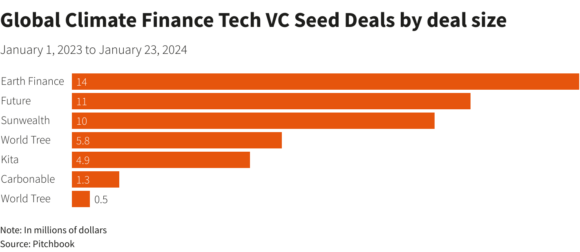

That’s the second-biggest local weather finance seed funding spherical globally and the most important in Europe for the reason that begin of 2023, business tracker PitchBook mentioned.

The corporate’s strategy ensures firms shopping for carbon credit will obtain the permits they’ve ordered even when the issuer can not ship them – for instance, if the forest backing a credit score is destroyed by wildfires.

CarbonPool plans to do that by shopping for high-quality carbon credit that it’ll carry on its steadiness sheet and pay out when wanted.

Uncertainty on whether or not permits will likely be delivered is one problem holding again market progress, co-founder and Chief Working Officer Nandini Wilcke instructed Reuters.

“(Consumers) are within the uncomfortable place that proper now there’s no assure that the offsets they purchase upfront are literally going to materialize and… within the quantity that they’re anticipating and reporting on of their monetary disclosures.

“Insurance coverage is principally the lacking piece.” The strategy, at the moment being assessed by the Swiss regulator, is beforehand unreported.

Information gathered between 2000 and 2023 and shared with Reuters by business tracker AlliedOffsets reveals the common issuance success fee for carbon permits was simply 45%.

Failure to safe the anticipated credit can depart company consumers in need of these wanted to fulfill their local weather objectives.

Whereas firms issuing carbon permits can already insure the property that again them, no supplier at the moment pays for the worth of the carbon credit score itself.

“In case you have a fireplace, what they pay you again is the sum of money you spent to place these timber within the floor,” mentioned Peter Fernandez, CEO of Brazilian carbon elimination start-up Mombak, which is backed by traders together with AXA Funding Managers and Bain Capital.

“They don’t pay you again the carbon credit that you simply misplaced, which is a way more costly factor.”

“What we want is ‘you lose carbon credit, you get again carbon credit’.”

($1 = 0.8629 Swiss francs)

(Further reporting by Susanna Twidale; enhancing by Jan Harvey)

Subjects

Allianz

An important insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage business’s trusted e-newsletter