Procuring round and switching has fallen notably for the reason that value strolling ban.

With an industry-wide regulator-enforced assure that renewing prospects wouldn’t be charged greater than if that they had been a brand new buyer.

Within the residence market, 76.1% of consumers shopped round in April-June 2019, dropping to 71.5% in April-June 2022. Switching fell from 37.1% to 34.7%.

In the meantime within the motor market, procuring dropped from 83.1% to 79.4%, and switching from 39.7% to 36.9% in the identical three-year interval.

However with the cost-of-living disaster biting tougher, shoppers could nicely discover and realise that there are financial savings available, even when their renewal quote hasn’t jumped up.

So what’s at the moment motivating procuring and switching behaviour – and what can suppliers study from it forward of the anticipated spending crunch?

Dwelling insurance coverage procuring and switching

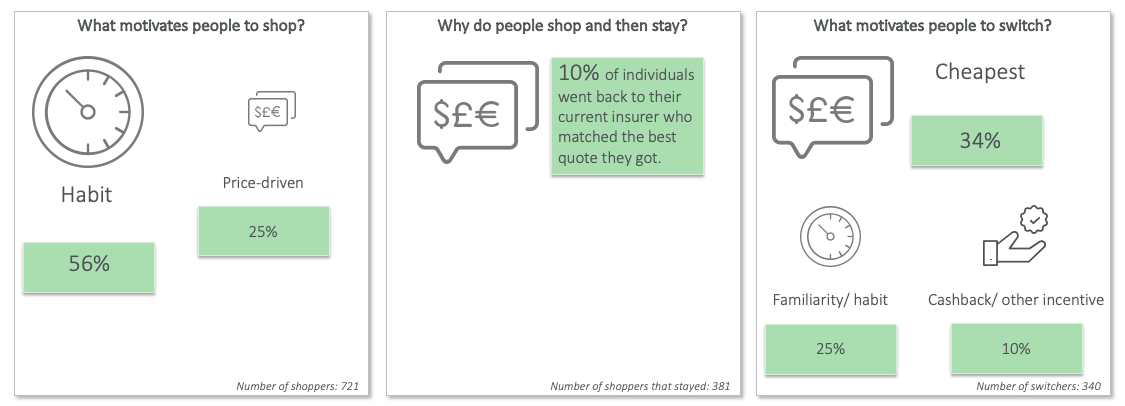

In Dwelling, it’s attention-grabbing to see that solely 25% of buyers are at the moment pushed by value. 56% store out of behavior – having been educated over a few years that go (dot) evaluating the market is one of the best ways to get the most effective deal.

Some 10% of these buyers selected to stick with their present supplier after seeing what else was on the market.

Of people who do change, solely 34% have been motivated by the most affordable value, and solely 10% by incentives like cashbacks. 1 / 4 are switching primarily out of behavior.

Motor insurance coverage swapping and switching

In Motor insurance coverage, barely extra buyers have been value pushed – 14% as a result of their quote had gone up lots at renewal and 13% who needed to make use of a quote to renegotiate with their present insurer. An extra 56% stated they store round annually on precept.

Motor prospects are way more motivated to really make the change by the most affordable value – with 50% citing it as their predominant motive for altering suppliers.

The place now?

Because the rising value of residing takes maintain and prospects start to really feel the pinch, we’re anticipating to see procuring charges improve. The large query is whether or not switching charges will go up, and that may solely occur if prospects really feel as if they’re saving cash by switching.

With cash being an enormous motivating issue already – particularly in motor – it’s seemingly individuals shall be keener for a deal.

This implies new new-business alternatives – however there are additionally alternatives to extend the variety of buyers who select to remain after wanting round. Sure, value goes to be essential, however it’s clearly not the one entrance on which to struggle for them. Communication shall be completely key – particularly for purchasers thrown into monetary vulnerability, and on the level of a grudge expenditure. How can they be made to really feel secure and valued? Will perks out of the blue begin to imply extra – or much less as individuals reduce down on journeys to the cinema and eating places?

What we should be certain of is that the proliferation of decrease worth insurance coverage merchandise we’ve seen getting into the market doesn’t imply that saving cash leads to compromising cowl.

Suppliers have a duty to offer, and articulate, truthful worth. These ready to take action would be the ones who show hottest with cost-of-living buyers and switchers.

[September Report] Value of Residing Shopper Behaviour Tracker

With our ‘Value of Residing’ Shopper Behaviour Tracker, you possibly can monitor altering sentiment, attitudes, and behaviours, as shoppers proceed to face the rising value of residing.

Touch upon weblog submit . . .