The photo voltaic panels quickly being deployed throughout the nation are susceptible to break from hail and expensive to interchange, limiting their threat switch choices. Parametric insurance coverage injects some much-needed flexibility.

The subject of local weather change and what we will do to confront it has by no means been extra top-of-mind — so it’s no marvel that solar energy is rising in reputation. New actual property growth calls for brand new sources of vitality, and the push is on for extra renewables. In response to the usEnergy Data Administration, the primary 9 months of 2023 noticed the set up of a report 15.8 GWac of photovoltaic capability, a rise of 31% over the earlier 12 months.

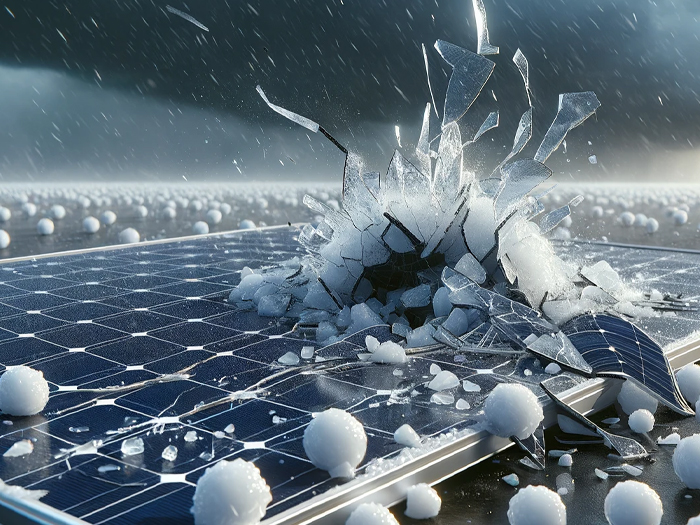

On the similar time, hailstorms have been rising extra extreme, and very often in areas which can be in any other case seen as prime areas for photo voltaic farms. Photo voltaic panels, although, are extra susceptible to hail injury than most different classes of property; giant hailstones can shatter photo voltaic panels, and even smaller hail can create “invisible” injury that permits panels to proceed functioning however with lowered effectiveness, producing much less electrical energy and producing much less income.

In 2023, the mix of fixing climate patterns and rising growth in new geographies resulted within the P&C market’s worst 12 months in a decade. Regardless of final 12 months’s comparatively tame hurricane season, the U.S. witnessed extra $1 billion-plus climate occasions than we’ve ever seen — of the 28, 17 have been extreme climate and hail occasions.

A latest CoreLogic report discovered that this convergence of elevated photo voltaic capability and extra extreme hailstorms is very pronounced in Texas, the Southeast and the Plains. The report depicts a transparent rising development within the variety of days of hail over 2″ in diameter every year — and final 12 months was a very lively one. In 2023, Louisiana noticed 65% extra days with 1″ hailstones in comparison with the 20-year development, Tennessee 60%, Alabama 54% and New Mexico 45%.

With 42% extra days of 1″ hail in 2023 than common, Texas was not far behind — and Texas is a vital market all by itself. Not solely is it by itself grid (ERCOT, which generates greater than 12% of the nation’s complete electrical energy and consumes extra vitality than another state), however it’s additionally one in all three states that account for the lion’s share of latest photo voltaic panel installations: In 2023, 11% of latest installations and 20% of latest deployments have been in Texas. Collectively, California and Texas account for 62% of the nation’s grid-scale installations.

A GCube report from late final 12 months confirms that the impact of those intersecting tendencies is already being felt: Hail is now answerable for greater than half of all photo voltaic claims prices, regardless of constituting solely a fraction of photo voltaic claims by quantity. The typical photo voltaic hail declare now involves a whopping $58.4 million. And insurers are feeling the pinch: In 2023, The New York Instances reported, State Farm’s hail claims totaled over $6 billion — greater than the earlier two years mixed.

If there’s one factor that’s true of hail, it’s that what goes up should come down. Can the identical be stated of its dangerous results? Is it attainable to handle the chance of photo voltaic losses attributable to hail and reverse this worrying development?

Provide & Demand

Threat & Insurance coverage not too long ago spoke with Brenden Beeg, enterprise growth supervisor, North America, Descartes Insurance coverage (a parametric insurance coverage supplier specializing in modelling local weather and rising dangers that gives parametric options towards hail threat), and Brendan Fountain, vp, vitality & marine, Alliant Insurance coverage Providers (a dealer who has positioned these insurance policies prior to now).

As Fountain defined, the price to interchange broken photo voltaic tasks has gone up attributable to inflation on the whole, the tight labor market, and provide chain points associated to the elevated general progress of photo voltaic described above.

Brendan Fountain, vp, vitality & marine, Alliant

“There’s an incredible quantity of investment-supported administration coverage to construct out these tasks,” Fountain stated. “For instance, the IRA [Inflation Reduction Act] extension of the tax credit for renewable vitality technology consists of adders for each home content material and home labor to qualify a few of these general credit.”

Fountain continued, “If we’re speaking about provide chain and inflationary considerations, it then comes all the way down to what number of undertaking house owners and builders wish to fulfill home necessities throughout the IRA, and the way a lot does that create congestion for undertaking house owners within the provide chain? After which, like the rest, discovering the labor to assist the demand for brand new tasks — irrespective of the trade, there’s at all times a query of the provision of skilled labor.”

A rising value to interchange swiftly interprets into rising value to insure. And for all our inexperienced vitality ambitions, this leaves each insurers and insureds in a tough spot.

“Photo voltaic underwriters constantly monitor their publicity aggregations, particularly in states like Texas or Colorado, the place there is usually a giant focus of threat,” Beeg stated.

“Going again to the laborious market, there was a big demand and provide imbalance. Asset house owners are required to hold a specific amount of insurance coverage protection for these Nat CAT perils, so the imbalance has led to challenges for each the asset house owners and the underwriting aspect of issues. For underwriters, it goes again into the reinsurance market; to observe these aggregations, there must be further reinsurance capability out there, and doubtlessly, there’s simply not the capability out there in sure conditions.”

Product producers, threat engineers, the IBHS and others are laborious at work to develop extra sturdy photo voltaic panels, new methods of defending them from hail, and improved finest practices for his or her set up, deployment and stowing — all in an effort to chop down on future losses. In time, we will count on new strategies of loss avoidance to bear fruit.

In the meantime, energy undertaking house owners can work carefully with their unique tools producers to grasp the tolerances of their merchandise and what they will do to protect their integrity — they usually can watch the skies.

However even with their photo voltaic arrays put in and maintained in line with present finest practices, house owners trying to shield these property will proceed to rely closely on threat switch for the foreseeable future.

Bespoke Protection

With the demand for protection excessive and prices rising, parametric covers give photo voltaic undertaking house owners struggling to seek out insurance coverage some further choices.

“It’s no secret that the final property market is trying to impose elevated deductions, decrease sublimits and improve premiums for tasks which can be positioned in areas susceptible to pure catastrophic occasions,” Fountain stated. “So it turns into the accountability of brokers to conduct vital due diligence for the advantage of our purchasers, to actually perceive their inherent threat and the way, from a know-how perspective, our purchasers have mitigated that threat. From there, we will have interaction the insurance coverage market to develop efficient options.”

He added that the advantage of a parametric coverage is that it has “the flexibility to tailor protection off very particularly designed and agreed-upon coverage triggers — specifically, hailstone measurement.”

Photo voltaic house owners can thus decide what measurement of hailstone their panels can face up to, calculate the likelihood that future hail will exceed that measurement, conclude how a lot threat they need to retain, after which very exactly make up the distinction between that retention and a basic P&C coverage.

“Finally, it offers us a excessive degree of specificity with how we will tailor the protection,” Fountain stated, “and in a approach that matches the undertaking traits … We are able to implement the protection to primarily purchase down deductibles that you could be discover in a typical property coverage, or we will substitute a coverage sublimit. Finally, it comes all the way down to every shopper’s particular threat tolerance.”

Quick & Straightforward

Parametric hail covers have one other benefit over basic P&C: Settling claims is much easier and sooner.

Brenden Beeg, enterprise growth supervisor, North America, Descartes Insurance coverage Options

“It’s primarily based on radar imagery,” Beeg stated of how insurers decide whether or not a coverage has been triggered. “The U.S. has good radar infrastructure; there are Doppler radars networked all through the nation, and we work with third-party knowledge suppliers that precisely certify that knowledge. We’re ready to take a look at, in fairly granular views, the hail swath or the hail observe of an occasion and see what hailstone sizes have been falling, and we will see what space of the asset was impacted.”

This alone may also help companies to maintain their backside line in test. “It’s goal in nature; every thing is extraordinarily clear, so from a budgeting perspective, it’s somewhat bit simpler to anticipate,” Beeg added.

“After which when it comes all the way down to an precise declare occasion, from the purpose of a triggering occasion to the cash really flowing, you’re inside a couple of 30-day window,” Beeg stated. “It is a fully totally different state of affairs in comparison with the normal indemnity markets, which oftentimes undergo extraordinarily detailed forensic changes or different sorts of processes … Relying on the category of enterprise, it might be outdoors of a 12 months earlier than a [traditional] declare is absolutely adjudicated.”

Lastly, Beeg stated, “one other key good thing about parametric insurance coverage is that it doesn’t have to stick to bodily injury or enterprise interruption. The restrict in danger is basically all when it comes to financial injury, so actually something that might be sublimited, wherever there’s gaps or there’s exclusionary wording on the normal aspect of issues, parametric payouts could be utilized to offset or take up that financial injury burden. There’s quite a lot of flexibility. There’s quite a lot of transparency. After which there’s simply general pace and liquidity.”

Finally, Fountain added, nearly everybody desires to see photo voltaic succeed, so fairly than protecting their perception into methods to shield tasks to themselves, stakeholders generally tend to share info freely.

“It’s a rising sector,” Fountain stated. “There’s an incredible quantity of governmental incentive happening. And usually talking, quite a lot of what we’re speaking about right here is simply methods to proceed to enhance — whether or not it’s threat, undertaking efficiency, or different issues to that impact. [As brokers,] we’re at all times looking for methods to align our purchasers with good companions, with Descartes or the final P&C market, with insurers. We’re keen to share this knowledge, share this info to optimize our tasks.”

“It’s a rising sector,” Fountain unhappy. “There’s an incredible quantity of presidency coverage driving funding into renewables. Usually talking, quite a lot of what we’re speaking about listed here are different options to assist our purchasers’ tasks — whether or not it’s engineering suggestions to enhance undertaking efficiency in these pure catastrophe-prone areas or different threat options resembling parametrics. The willingness to share this impactful info can solely assist our purchasers optimize their tasks. [As brokers,] we’re at all times looking for methods to align our purchasers with good companions resembling Descartes and different insurers who assist that objective.” &